Our experts are eager to share their knowledge and guide you through the life settlement process.

Unlike applying for insurance coverage, no medical exam is required in the life settlement process. Buyers will review the last 3 years of medical records for the purpose of providing offers. Certain situations do not require any medical review at all.

The right to sell your life insurance policy, like any other piece of property/asset, is available in all 50 states.

With the retirement crisis and increased medical costs, more senior policy owners are using life settlements to unlock the value of unwanted/unneeded life insurance policies and use the funds for all sorts of needs like funding retirement, long-term care, or medical expenses.

Companies on TV are licensed to represent investors, not policy owners. Their objective is to pay the lowest amount possible for a policy without competition. Ashar is a fiduciary to the policy owner and through our competitive auction process, we secure hundreds of millions each year for families looking to solve everyday needs. Since 2003, Ashar has been focused solely on the life settlement and life insurance policy valuation space and has earned the reputation of a trusted resource.

While we’re licensed to represent the seller in a life settlement transaction, Ashar also works alongside financial professionals for the clients they serve. We believe policy owners are best served when their planning professionals are involved in any complex decisions about their life insurance. Either way, our sole fiduciary duty is to you – the policy owner. Ashar has relationships with thousands of reputable financial professionals in every practice area – insurance planning, tax planning, retirement planning, wealth management, charitable planning, etc. If you need a recommendation, let us make the connection. We’re here to help.

It depends on several factors like cost of insurance changes or significant changes in insured’s health. Like all markets, sometimes it’s a seller’s market and sometimes it’s a buyer’s market. Also, the market is impacted by buyer’s purchase parameters. Ultimately, families should consider the cost of continued premiums and managing the policy should they decide to keep it in the hopes of selling it in the future. What if the insured lives longer than projected? Does the policy owner have the liquidity available to maintain the policy?

Most buyers are looking at policy type, age and health of the insured, and premium requirements to make a determination of offer. Each life settlement buyer is a fiduciary to multiple investors, each with their own unique set of purchase parameters. Based on policy details and insured health status, we will reach out to our extensive network of institutional buyer relationships for offers. If you have an unneeded/unwanted policy, are ages 60s to 90s, and have had a decline in health since your policy was issued, you could qualify for a life settlement solution. Younger insureds with significant health issues can also qualify.

The overall value depends on several factors: policy type, premium amount, cash surrender value, insured’s health, and buyer’s purchase parameters. Most policy owners only know what the death benefit is in the event of the insured’s passing. Beyond that, some policies accumulate cash value – the amount the policy owner would receive if the policy were surrendered (less any carrier/outstanding fees). In the life settlement transaction, there are two values: the offer that is received without a policy auction and the fair market value (highest value) – achieved only through a true policy auction. Find out if your policy could have value.

Ashar can provide a range of potential value with some policy and medical information within a day or two. The entire process takes on average about the same amount of time as selling your house. Ashar’s experienced team is dedicated to compressing timeframes and delivering a quick result to every policy owner and financial professional we serve.

Experienced life settlement resources work with qualified licensed purchasers. These purchasers are obligated to the investors they represent and are comprised of some of the most well-known institutional investment groups – pension plans, private equity, and asset managers. Ashar requires each buyer relationship to complete a due diligence process. We never work with purchasers who represent individual investors, or those that do not abide by all applicable regulatory requirements.

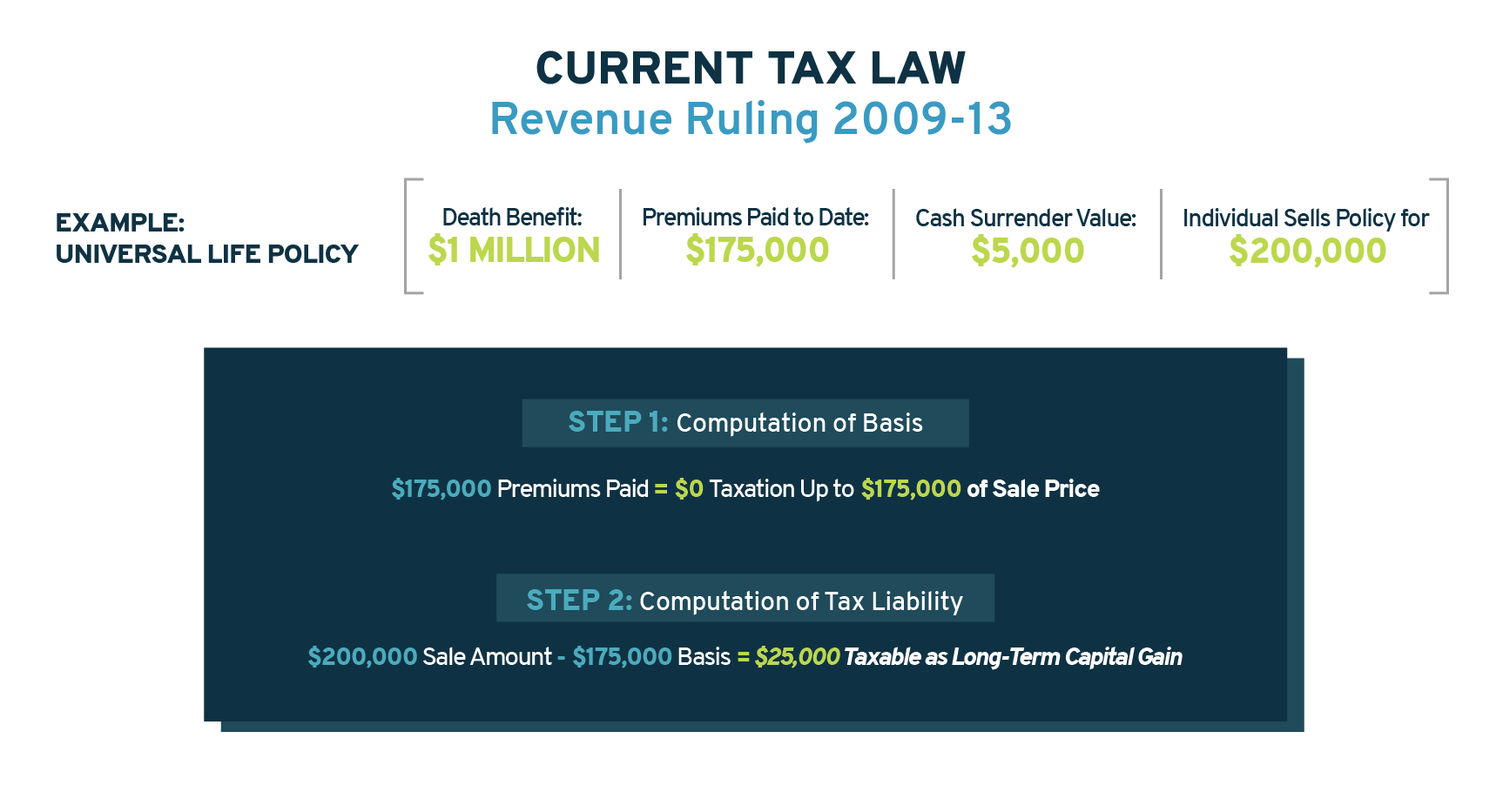

Money received from a life settlement is tax free up to the basis (premiums paid into the policy). From the basis to the cash surrender value is treated as ordinary income. All proceeds that exceed the cash surrender value is taxed as capital gain. *Disclaimer: This information is for educational purposes only. Ashar does not provide tax advice. Please speak with your tax professional for more information.

Direct buyers’ fiduciary duty is to the funds they represent when purchasing policies, not the client. Their objective is to pay the lowest amount possible, so they receive the highest return for their investors. Ashar sits on the same side of the table as you and your client. Our sole responsibility is to the policy owner. Through our competitive auction platform, we leverage multiple buyers’ offers to negotiate the highest offer. While a direct buyer’s offer will be higher than the policy’s cash surrender value, only through a true competitive auction can the seller receive the fair market value for their policy.

No, maintaining control of the information submitted to buyers ensures your client’s data is used solely for the purpose of obtaining the highest value. It’s all about buyer competition, not life settlement fiduciaries sending mixed messages to the market. Ashar will securely submit the policy to licensed buyers and facilitate the auction process on behalf of your client. Controlled, exclusive policy control is in the best interest of the policy owner and receives the most aggressive offers during the auction process.

Ashar does not sell life insurance, manage assets, nor purchase policies. This means we are dedicated to ensuring your clients receive the highest offer for their life insurance policy and we will protect the integrity of the process and the relationships you have spent your career building.

First, Ashar does not partner with lead gen companies that sell your client’s data to other companies. Second, Ashar transfers data through our secure policy auction platform and shares it only with necessary parties.

As a licensed life settlement broker, Ashar has a fiduciary duty to protect the best interests of the policy owner/seller in the life settlement process. We sit on the same side of the table as you and your client. It’s always about what’s best for the policy owner, not the buyer. Whether it’s our expedited approach or a more traditional path of taking the policy to market, the result will be defensible with all parties feeling confident that the seller’s needs were met. Taking the time to properly position the policy and force competition between a group of vetted, qualified buyers ensures the seller receives much higher offers than the opening bid of a single buyer.

Ashar’s executive team members are respected thought leaders in the secondary market, speaking both nationally and internationally on the topics of life settlements, policy valuations, and the impact of increased longevity on planning with senior clients. They’re supported by a team of experienced analysts who keep the promises they make on the front stage. We offer exclusive education for teams like yours so they learn new ways to meet client needs – whatever they may be. From one-on-one sessions to webinars, guest speaking events, marketing tools, newsletter content, and more, we meet you where you are so you can meet your goals. Topics range from general market overviews to success stories to in-depth life insurance policy valuation methodologies. The education possibilities are endless.

Ashar is a nationally licensed independent seller’s representative and does not sell life insurance, manage assets, nor purchase policies. Backed by our proprietary auction platform, our team of longevity and in-house valuation experts deliver the best results for policy owners.

Every state allows for the life settlement transaction. Like any other asset/property, it is a policy owner’s right to sell a life insurance policy. Some states even require disclosure of the life settlement option as an exit strategy. Additionally, all forms are regulated by each state’s department of insurance.

In the age of best interest regulations, many are concerned with the potential liability of not disclosing the life settlement option and a policy owner canceling a life insurance contract that was worth five to 10 times more than the cash surrender value. We represent thousands of policy owners each year to provide information so they can decide whether to keep or sell their life insurance.

Experienced life settlement resources work with licensed purchasers. Each of these purchasers represent multiple funds comprised of some of the most well-known institutional investment groups – pension plans, private equity, and asset managers. Ashar requires each buyer relationship to complete a due diligence process. We never work with purchasers who represent individual investors, or those that do not abide by all applicable regulatory requirements.

Yes, we represent thousands of policy owners each year to provide information so they can decide whether to keep or sell their life insurance. We understand how to protect client’s information and abide by all applicable regulatory requirements.