Independent Resource. Stellar Results.

Are you discussing life insurance valuation and life settlements with your clients? If not, someone else will. Differentiate yourself by including the discussion in your policy review process. Get ahead of underfunded, unneeded, or unaffordable policies, and solve the financial concerns your clients are facing like saving for retirement, funding long-term care, or avoiding bankruptcy.

Any life settlement resource can secure an offer for your client’s policy.

We strive for more.

Ashar is licensed as a fiduciary to represent the policy owner and employs a proprietary policy auction platform that ensures your client receives the fair market value for their life insurance policy. Buyers have an infrastructure to maximize the return to their investors – not the policy owner. You and your client need the same representation on your side to ensure maximum results for the policy owner. With our turnkey approach to policy appraisal and the life settlement process, you’ll have confidence that your clients, their families, and their businesses have the representation that ensures they pursue the optimal pathway, and their best interests are served.

Direct buyers’ fiduciary duty is to the funds they represent when purchasing policies, not the client. Their objective is to pay the lowest amount possible, so they receive the highest return for their investors. Ashar sits on the same side of the table as you and your client. Our sole responsibility is to the policy owner. Through our competitive auction platform, we leverage multiple buyers’ offers to negotiate the highest offer. While a direct buyer’s offer will be higher than the policy’s cash surrender value, only through a true competitive auction can the seller receive the fair market value for their policy.

No, maintaining control of the information submitted to buyers ensures your client’s data is used solely for the purpose of obtaining the highest value. It’s all about buyer competition, not life settlement fiduciaries sending mixed messages to the market. Ashar will securely submit the policy to licensed buyers and facilitate the auction process on behalf of your client. Controlled, exclusive policy control is in the best interest of the policy owner and receives the most aggressive offers during the auction process.

Ashar does not sell life insurance, manage assets, nor purchase policies. This means we are dedicated to ensuring your clients receive the highest offer for their life insurance policy and we will protect the integrity of the process and the relationships you have spent your career building.

First, Ashar does not partner with lead gen companies that sell your client’s data to other companies. Second, Ashar transfers data through our secure policy auction platform and shares it only with necessary parties.

As a licensed life settlement broker, Ashar has a fiduciary duty to protect the best interests of the policy owner/seller in the life settlement process. We sit on the same side of the table as you and your client. It’s always about what’s best for the policy owner, not the buyer. Whether it’s our expedited approach or a more traditional path of taking the policy to market, the result will be defensible with all parties feeling confident that the seller’s needs were met. Taking the time to properly position the policy and force competition between a group of vetted, qualified buyers ensures the seller receives much higher offers than the opening bid of a single buyer.

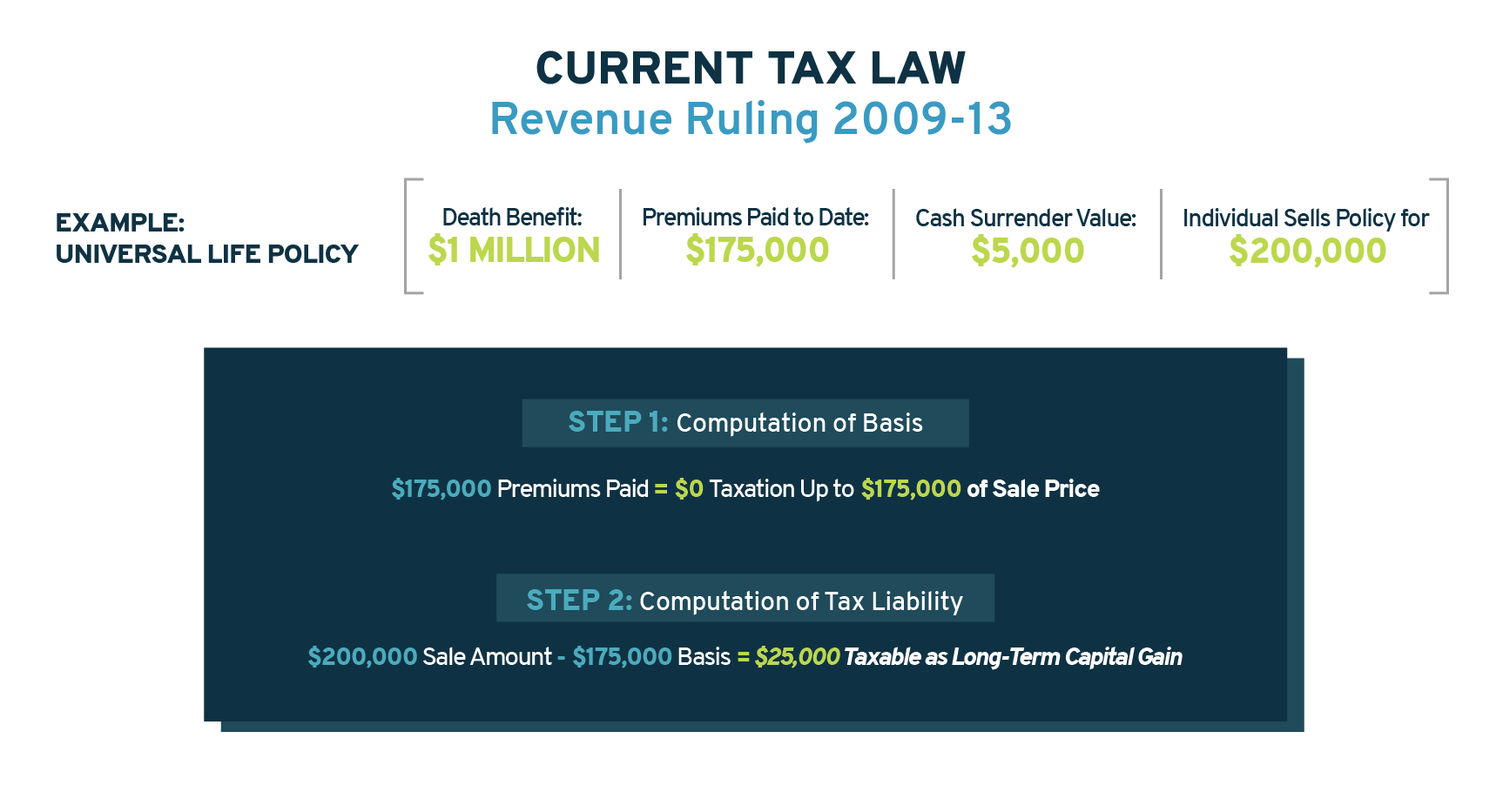

Money received from a life settlement is tax free up to the basis (premiums paid into the policy). From the basis to the cash surrender value is treated as ordinary income. All proceeds that exceed the cash surrender value is taxed as capital gain. *Disclaimer: This information is for educational purposes only. Ashar does not provide tax advice. Please speak with your tax professional for more information.